As a healthtech startup, you can’t help but get excited when Bob Kocher (Venrock) or Esther Dyson speak about the opportunities in healthcare given their impressive track records. Both spoke during this past week’s StartUpHealth Summit.

One of Bob’s main points was that the opportunity in healthcare is so big that most startups are thinking too small and his firm is putting their money where his mouth is (e.g. Castlight). Esther has proven time and again to be very prescient — just go back and watch her old interviews on Charlie Rose over the years to see how accurately she predicts the future. She interrupted attending the JP Morgan presentations to visit with the StartUp Health Summit. Paraphrasing, she said companies like those in StartUp Health are the future. Rather than trying to steal share from the companies presenting at JP Morgan, startups should focus on creating the new market space, and the market will move to them…not the other way around.

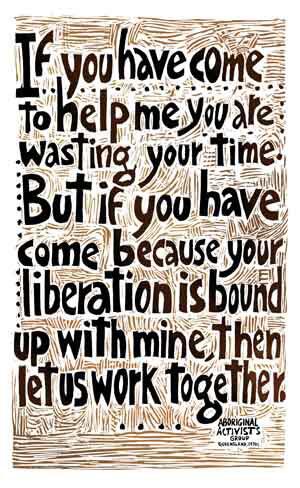

Transformers vs. Preservatives

While the opportunities are massive, what’s the biggest obstacle to healthcare transformers? It’s the “preservatives” — the incumbent healthcare players. That is, the preservatives are trying to protect the status quo, rather than focusing on how to sincerely address the Triple Aim (improve outcomes, reduce cost, improve patient experience). In every healthcare organization I’ve talked with, whether they are a provider, pharma, or health plan, there are transformers internally who know what to do but are stymied by preservatives.

The same is true politically. There are those who call themselves “progressive” or “conservative.” Unfortunately, it seems that 80 percent of politicos are actually preservatives just doing the bidding of lobbyists trying to protect the status quo. The preservatives are costing thousands of lives and hundreds of billions of unnecessary wasted dollars. The real leaders in healthcare will see through them and get them out of the way of progress.

One of the transformative organizations pushing for change is Oliver Wyman. Oliver Wyman is a leading consultancy that has setup a Health Innovation Center that recently published a paper entitled The Volume-to-Value Revolution (PDF) with the input of an advisory board (PDF) of CEOs ranging from large public companies to emerging companies (disclosure: I’m on the Health Innovation Center Advisory Board). In that paper, authors Tom Main and Adrian Slywotzky make the case that new patient-centered population health models will cause more than $1 trillion of value to rotate from the old models to the new and create more than a dozen new $10 billion high-growth markets (see also Patients Are More Than A Vessel For Billing Codes). Each of these markets creates large opportunities for healthtech startups. Naturally, legacy vendors are optimized for the old models (see Why It’s Good News HealthIT is So Bad) while startups optimize for the new models.

Most industries compete on value. U.S. healthcare does not. But that is about to change.

Healthcare innovators are already redefining healthcare value, putting patients first and inventing with little regard for current constraints. They have ignited a powerful, self-funding upward spiral by focusing first on healthcare’s big opportunities, transforming the value equation, generating large savings, and fueling smart reinvestment in the next wave of innovation. [Introduction, “The Volume-to-Value Revolution”]

In addition, the necessity for change and the accompanying opportunities are causing many healthcare incumbents to establish venture arms. See Strategic Healthcare Investors’ Investment Thesis for more.

Industry Boundaries Rapidly Crumbling

Everyone is getting into each other’s and new businesses. Industry incumbents would be well advised to learn from the mistakes of incumbents in other disrupted sectors. As I observed earlier, providers are making newspaper industry mistakes.

The changes the industry faces will be neither smooth nor linear. A period of intense turbulence will produce more losers and winners than any industry transformation in recent memory. Cross-industry competition (healthcare versus retail versus technology versus others) will erase traditional boundaries and generate exciting new value propositions for patients, payers, and physicians.

For example, just this past week, Walgreen‘s has made it clear they’ll compete with healthcare providers and insurance companies. Competition, as newspapers learned, doesn’t come from obvious places.

Consumerization Of Healthcare

The consumer empowerment taken for granted from everything from buying cars to planning travel is finally arriving in healthcare nearly 15 years later than most industries.

Consumers, long passive, will have a new role. Employer incentives, retail access, and new technology options will encourage them to engage, demand information, and push for value. Baby boomers reaching the age of peak healthcare need will kindle the fire and Millennials focused on nutrition and fitness will keep it burning. The industry’s metamorphosis from a supply-driven market to a more dynamic one driven by demand will happen more quickly and erratically than we expect. Inevitably, mental models will lag behind market reality, and conventional organizations will fight a rearguard battle, hampered by collapsing margins and eroding market share. [Introduction, “The Volume-to-Value Revolution”]

Walmart recently validated the domestic medical tourism I wrote about awhile back. Their Centers of Excellence program encourages their insured employees to go to the top facilities in the country for free (including travel expenses). The employees have to pay if they choose to go with organizations that haven’t demonstrated a willingness to have a fixed price while producing some of the best outcomes in the world. Love them or hate them, Walmart has a huge ripple effect. Overnight, every facility in America that does cardiac, spinal, or transplant procedures is now competing with Mayo, Cleveland Clinic and other top providers. Sticking to old models and tools endangers the traditional healthcare player.

By 2014, as many as 85 million consumers with $600 billion in purchasing power may be shopping for their own healthcare on public and private exchanges. Many will be making their own decisions about coverage for the first time. Consumers will shop not just for insurance, but also for their preferred population-health manager and standalone services, such as basic procedures and retail clinics. [pg. 18, “The Volume-to-Value Revolution”]

New Models Jeopardize Hospitals

Many are predicting half of hospitals will close by 2020. In Denmark, nearly 70 percent of hospitals closed as they made the shift from a reactive, sick-care model to proactive care model. More clinicians than ever will be needed. They’ll simply have a mainframe-to-smartphone like shift as outlined inhealthcare’s age of agility. Unfortunately, the average hospital is one of the most dangerous places with over 100,000 hospital-acquired infections causing death every year. Hospitals are almost always the most expensive place to deliver care so smart health systems are developing new models with a fresh start — what I call the Xboxification of Healthcare.

One of the reasons providers are choosing cloud-based systems over on-premise software is the resource-intensive deployments required with legacy systems. We’ve seen a small clinic get their cloud-based system fully setup and ready to use in 30 minutes without any onsite people. In contrast, in that same amount of time, one might be able to order the server that gets shipped to that clinic. They will then require onsite installers, trainers, etc. and have a dramatically higher cost base to run that system.

For entirely rational reasons, those older systems were optimized for internal workflows and maximizing billing since that is what has been rewarded historically. To think that those traditional systems will then work perfectly well in the ascending “No Outcome, No Income” era borders on delusional. The reality is hitting right away. A recent article in a HIMSS publication quoted a leading thinker in healthIT, Shahid Shah, outlining 9 major gaps in existing EHRs. He listed “sophisticated patient relationship management (PRM)” as the first major gap. It’s my opinion that as integral as EHRs have been to fee-for-service, PRM will be to fee-for-value. The old model relegated patient portal functionality to be little more than a marketing checkbox. In the new model, PRM functionality becomes a linchpin. In other words, patient portals have been like pre-Google web search (low value afterthoughts on web portals). As Google demonstrated, with the right circumstances, there was huge value ignored by the established players. Likewise, if PRM is viewed as an afterthought, that will increase the risk to providers during this transformative period. Being flat-footed in a time of great change is extremely risky.

The New York Times reported this past week that the public hospitals are already changing the way they compensate their doctors. The first performance measure they listed was how well patients say their doctors communicate with them. These doctors are used to easy communication in the rest of their life with email, text, Facebook, etc. Suddenly, the hospital IT departments are going to start hearing from doctors asking why they can’t have tools that are as easy to communicate with their patients in the other areas of their life. It’s a rare occurrence to hear a doctor say how user-friendly and patient-focused their EHR is. Of course, it’s about more than just technology. The technology simply enables new models. Despite many doctors’ fears, often the changes are for the better as was mentioned by Dr. Bob Margolis, founder and CEO of HealthCare Partners, and one of the physician leaders who has demonstrated extraordinary outcomes:

You get to the tipping point, where the physicians go, ‘Wow, life is a whole lot better.’ You know, I only have to see 20 patients a day and I go home at night and I feel like I really helped them’—as opposed to, ‘I saw 45 patients, worked until 10 o’clock because I had to then do all my paperwork, I’m tired and I can barely pay the bills because Medicare and the commercial insurers are cutting back on my reimbursement.’

Oliver Wyman’s report projects that patient-centered care and the shift to value will eliminate $500 billion in low-value-add activities. One has to be in major denial as a healthcare leader to think that we aren’t entering a deflationary era in healthcare. Just watch Bill Gates’ TED Talk on state budgets if you have any doubts. This is exactly the reason the state of New York has moved aggressively to change care and payment models. While doing that, they recognized new models require new technology and didn’t expect they’d get it from legacy providers. This is why the New York Digital Health Accelerator was established. The good news for proactive health systems is that one can thrive in a deflationary period if they shed old assumptions.

A leader at Virginia Mason in Seattle shared how Starbuck’s pushback on costs caused them to look at their entire care proces:

“90 percent of what the hospital was doing was of no value.” As it turns out, the best way to treat most back pain is with physical therapy. That insight led to new processes, including same-day visits (as opposed to 31-day waits), reduced use of imaging tests and prescription drugs, and the addition of psychological support. Within three months, 94 percent of Starbucks employees with back-pain complaints were back at work within a day.

Even today, many EMR vendors will justify the price tags that reach into the hundreds of millions of dollars on the basis of increased billings. That game is nearly over and those hospitals will be saddled with systems optimized for the old models. This past week there were articles in the New York Times and Washington Post stating that EHRs have “failed”. I’d dispute that. EHRs have done exactly as they were designed — maximize billings. That’s how they are pitched so it should be no surprise that costs haven’t been lowered.

It has been said that “when the rate of change outside exceeds the rate of change inside, the end is in sight.”

Three Waves Of Disruption

Below, I have excerpted and paraphrased some more of Oliver Wyman’s insights from the Volume-to-Value paper illustrating how each of the three anticipated waves of disruption will shift hundreds of billions of revenue from one set of players to another:

Wave 1: Patient-Centered Care (2010-2016). “If we simply mainstreamed today’s best-in-class models of patient-centered, population-health management, the U.S. health system would eliminate nearly $350 billion of low-value-add activity and shift another $600 billion from provider-centered care models to patient-centered care models.” […] ”Five percent of Americans account for 45 percent of healthcare spending—$1.2 trillion. These 15 million unhealthy Americans at the top of the healthcare pyramid are at the heart of the near-term healthcare affordability crisis and the unfortunate victims of our fragmented, illness- focused healthcare system.” [pages 5 and 7, “The Volume-to-Value Revolution”]

Wave 2: Consumer Engagement (2014-2020). In Wave 2, another $150 billion in low-value-add activities is squeezed out, while $400 billion of additional value will rotate to the new retail value chain.

Wave 3: The Science Of Prevention (2018-2025). Wave 2 will help Wave 1’s great population managers become even more effective and will devastate provider-centric players who have lagged the market. Wave 3 will make the most highly evolved and adaptive population health managers more powerful and will significantly constrict the Wave 1 players who don’t continue to accelerate innovation.

Big Opportunities Require Big Brains

I once heard someone say, “There’s a lot of big brains working on small problems.” They were commenting on the brainpower working on the 8,000th social media app versus where they should be applying their brains. That is, there are three areas that demand as many big brains as possible — healthcare, education, and energy. As a skier, I often say that healthtech startups are the double black diamond in whiteout conditions of startups: super challenging and exhilarating but not for the faint of heart.

I believe the trick is to understand the idiosyncrasies of healthcare without being shackled by them. If you want to make a difference, there’s no better place than healthcare. Healthcare needs all the engineering talent possible that is often wasted on low-impact areas of the tech industry.

Follow @chasedave on Twitter or request the Care Beyond the Clinic newsletter for ongoing updates on healthcare innovation and disruption.

Illustration: Jim Pavlidis.

Illustration: Jim Pavlidis.